October 28, 2015

Record-High Book-to-Bill of 3.49 and Strong Backlog of $12.55 billion

Revenue Increased 1.3 percent, to $1.32 billion

Adjusted EBITDA of $124 million

Adjusted Diluted Earnings per Share of $0.39

Quarterly dividend of $0.13 per share, payable on November 30, 2015

McLean, Va — Booz Allen Hamilton Holding Corporation (NYSE:BAH), the parent company of management and technology consulting and engineering services firm Booz Allen Hamilton Inc., today announced preliminary results for the second quarter of fiscal 2016.

The Company’s emphasis on bid and proposal activities in the first half of the fiscal year contributed to a very strong award quarter with a book-to-bill ratio of 3.49, the highest since the Company became public in 2010, and total backlog of $12.55 billion, the highest in nearly three years. This achievement in contract awards reflects the success of the investments the Company has made over the last several years in people, capabilities, markets, and innovation.

“We had a very strong second quarter,” said Horacio Rozanski, President and Chief Executive Officer. “Our team’s great success in winning new business affirms our long-term strategy to achieve sustainable, quality growth by providing our clients with superior people, capabilities, and mission knowledge so that we solve their toughest problems and advance their most important missions.”

During the second quarter, the Company’s revenue increased by 1.3 percent over the prior year period to $1.32 billion, despite challenges presented by the end of the Company’s largest contract in July. The Company successfully transitioned a majority of the work from the SURVIAC contract to new vehicles and won the vast majority of the competitions for replacement task orders or contracts. The revenue gap from the transition of the contract was within the previously disclosed expected range of $100 million to $200 million, and over 90 percent of affected staff have transitioned to follow-on tasks or new contracts.

Adjusted EBITDA margin for the second quarter of the fiscal year was 9.4 percent, compared to 10.6 percent in the prior year period. Bottom-line results reflect the impact of higher spending on bid and proposal activity and strategic investments, plus the cost of retaining staff during the SURVIAC transition. Unlike fiscal year 2015, Adjusted EBITDA margins and spending in the second half of fiscal 2016 are anticipated to be roughly flat as compared to the first half of the current fiscal year.

The Company authorized and declared a regular dividend of $0.13 per share, payable on November 30, 2015, to stockholders of record on November 10, 2015.

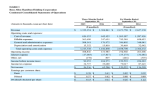

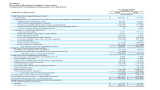

Financial Review

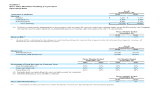

Second Quarter 2016 – Below is a summary of additional results for the fiscal 2016 second quarter and the key factors driving those results.

- Gross Revenue increased to $1.32 billion from $1.30 billion in the prior year period primarily as a result of an increase in billable expenses over the prior year period. Revenue on cost reimbursable contracts also benefitted from higher indirect cost spending.

- Adjusted Operating Income decreased to $109.9 million from $123.0 million in the prior year period. The decrease was primarily the result of increased indirect spending on bid and proposal activities, compared to prior years, to meet strong demand. The decrease also reflected the cost of retaining staff as they transitioned from work done under the SURVIAC contract to new or replacement task orders or contracts, and relatively higher spending on investments in growth platforms as compared to the prior year. These decreases were partially offset by improved profitability on certain contracts.

- Adjusted Net Income declined to $57.6 million from $66.7 million in the prior year period. The decline was driven by the same factors that impacted Adjusted Operating Income.

- Adjusted EBITDA decreased to $124.2 million from $137.8 million, and Adjusted EBITDA margins declined to 9.4 percent from 10.6 percent in the prior year period. The decreases were driven by the same factors as Adjusted Operating Income.

- Diluted EPS decreased to $0.37 from $0.42 and Adjusted Diluted EPS decreased to $0.39 from $0.44 in the prior year period. The decrease in Adjusted Diluted EPS was driven by the same factors as Adjusted Operating Income, partially offset by the impact of a decrease in the Company’s diluted share count.

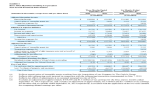

Due to the significant number of large contract awards during the quarter, backlog as of September 30, 2015, is more heavily weighted toward Priced Options, which provide more visibility into the revenue potential in fiscal year 2017 and beyond and supports Booz Allen’s strategy of delivering sustainable quality growth. Booz Allen’s total backlog as of September 30, 2015, was $12.55 billion, compared to $10.89 billion as of September 30, 2014. Book-to-bill was 3.49 for the second quarter of fiscal 2015, compared to 1.93 in the prior period.

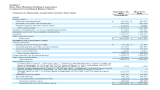

First Half Fiscal 2016 – Booz Allen’s cumulative performance for the first and second quarters of fiscal 2016, driven by the same factors discussed above, has resulted in:

- Gross Revenue of $2.67 billion for the first half of fiscal 2016, compared with $2.63 billion for the prior year period.

- Adjusted Operating Income for the first half of fiscal 2016 of $237.1 million compared with $265.2 million in the first half of fiscal 2015.

- Adjusted Net Income for the first half of fiscal 2016 of $123.4 million compared with $141.3 million in the prior year period.

- Adjusted EBITDA for the first half of fiscal 2016 of $265.4 million compared with $295.1 million in the first half of fiscal 2015.

- Diluted EPS of $0.80 and Adjusted Diluted EPS of $0.83 for the first half of fiscal 2016, compared with $0.89 and $0.94, respectively, for the first half of fiscal 2015.

Net cash provided by operating activities for the first half of fiscal 2016 was $88.7 million compared with $200.5 million in the prior year period. Free cash flow in the first half of fiscal 2016 was $59.1 million, compared with $191.6 million in the prior year period. The decline in operating cash flow was driven primarily by a significant reduction in working capital in the prior year period. The decline in free cash flow was driven by those same factors, as well as an increase in capital expenses related to the reconfiguration of the Company’s facilities footprint in the metropolitan Washington, D.C. area.

Financial Outlook

For our full fiscal year 2016 we are reaffirming the guidance we issued on May 21, 2015. We expect revenue to be roughly flat, with a range of two percent growth to a two percent decline. At the bottom line, for the full year, we are forecasting diluted EPS to be in the range of $1.55 to $1.65, and Adjusted Diluted EPS to be on the order of $1.60 to $1.70.

These EPS estimates are based on fiscal year 2016 estimated average diluted shares outstanding of approximately 149.5 million shares, and a 40.2 percent effective tax rate, which does not include federal and state tax credits that have not yet been extended or for which qualifications have not yet been established.

Conference Call Information

Booz Allen Hamilton will host a conference call at 8 a.m. EDT on Wednesday, October 28, 2015, to discuss the financial results for its Second Quarter Fiscal Year 2016 (ended September 30, 2015).

Analysts and institutional investors may participate on the call by dialing (877) 375-9141, International: (253) 237-1151. The conference call will be webcast simultaneously to the public through a link on the investor relations section of the Booz Allen Hamilton web site at investors.boozallen.com. A replay of the conference call will be available online at investors.boozallen.com beginning at 11 a.m. EDT on October 28, 2015, and continuing for 30 days.

BAHPR-FI