February 05, 2018

Excellent Top-Line Growth: Revenue Increase of 6.8 percent to $1.5 billion, and Revenue, Excluding Billable Expenses1 Growth of 8.3 percent

Continued Momentum in Hiring: Headcount Increase of More Than 1,700 Year-Over-Year and 522 from Prior Quarter

Strong Bottom Line Performance: EBITDA and Adjusted EBITDA1 Up 10 percent; Diluted Earnings per Share of $0.47 and Adjusted Diluted Earnings per Share1 of $0.48

Best Third Quarter Book-to-Bill Since IPO and Near-Record Total Backlog

Approximately $300 Million in Capital Deployed Through Quarter End

Quarterly Dividend Increased to $0.19 per Share

McLean, Virginia – Booz Allen Hamilton Holding Corporation (NYSE:BAH), the parent company of management and technology consulting and engineering services firm Booz Allen Hamilton Inc., today announced preliminary results for the third quarter of fiscal 2018.

Strong third quarter results, including revenue and earnings growth, headcount gains, and large backlog, demonstrate the fundamental strength of Booz Allen’s business and continued progress against its Vision 2020 growth strategy. By building its advanced capabilities and integrating them with consulting expertise, the Company has produced industry-leading organic revenue growth. It is increasingly positioned to provide the mission-focused technology solutions that clients are seeking.

“With three quarters of fiscal year 2018 behind us, Booz Allen is poised for another successful year, operationally and strategically,” said Horacio Rozanski, President and Chief Executive Officer. “We are on strategy and on track to deliver near- and long-term value to shareholders through top- and bottom-line growth, strong cash generation, and significant capital deployment.”

The Company reported a reduction in its income tax provision of approximately $11 million in the third quarter as a result of the Tax Cut and Jobs Act. For the full fiscal year 2018, the Company expects its effective tax rate to be between 33 and 34 percent, and, beginning in fiscal year 2019, expects this rate to decrease further. In addition, the Company expects significant tax savings in coming years, the majority of which the Company anticipates will benefit the bottom line. The Company plans to provide more specificity regarding its future tax savings on its fourth quarter earnings call. The Company does not expect its capital deployment plans to change as a result of the tax law.

Headcount increased by 522 during the quarter and year-over-year by more than 1,700. Total backlog increased by 23.2 percent to nearly $16.7 billion, a near record, and the Company generated a book-to-bill ratio of 0.99, a record third-quarter high result since the Company’s initial public offering.

The Company declared a regular quarterly dividend of $0.19 per share, an increase of 12 percent, which is payable on February 28, 2018, to stockholders of record on February 14, 2018.

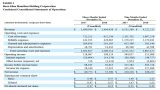

Financial Summary

Third Quarter Ended December 31, 2017 – A summary of Booz Allen’s results for the third quarter of fiscal 2018 is below. All comparisons are to the prior year quarter, and a description of key drivers for the quarter can be found in the Company’s Earnings Call Presentation for the third quarter of fiscal year 2018 posted on investors.boozallen.com.

- Revenue: $1.50 billion, an increase of 6.8 percent.

- Revenue, Excluding Billable Expenses:1 $1.06 billion, an increase of 8.3 percent.

- Operating Income and Adjusted Operating Income:1: Each $118.1 million, an increase of 9.2 percent and 8.2 percent, respectively.

- Net Income: $69.8 million, an increase of 25.5 percent; and Adjusted Net Income:1 $70.2 million, an increase of 24.1 percent.

- EBITDA and Adjusted EBITDA1: Each $134.8 million, an increase of 10.0 percent.

- Diluted EPS: $0.47, up from $0.37; and Adjusted Diluted EPS1: $0.48, up from $0.38.

As of December 31, 2017, total backlog was $16.7 billion, compared to $13.5 billion as of December 31, 2016, an increase of 23.2 percent. The Company ended the quarter with a cash balance of approximately $290 million, and during the quarter, the Company paid approximately $25 million in dividends and repurchased approximately 833 thousand shares. In the first three quarters, the Company has deployed $275 million in the form of regular dividends and share repurchases. Net cash provided by operating activities for the year-to-date period was $246.9 million as compared to $283.0 million in the prior year period. Free cash flow1 for the year-to-date period was 183.9 million, compared with $252.5 million in the prior year period.

Nine Months Ended December 31, 2017 – Booz Allen’s cumulative performance for the first three quarters of fiscal 2018 has resulted in:

- Revenue: $4.54 billion, an increase of 7.4 percent.

- Revenue, Excluding Billable Expenses:1 $3.16 billion, an increase of 7.0 percent.

- Operating Income: $384.0 million, an increase of 8.2 percent; and Adjusted Operating Income:1 $384.0 million, an increase of 6.2 percent.

- Net Income: $220.2 million, an increase of 18.3 percent; and Adjusted Net Income:1 $221.5 million, an increase of 13.5 percent.

- EBITDA: $432.2 million, an increase of 8.4 percent; and Adjusted EBITDA1: $432.2 million, an increase of 7.5 percent.

- Diluted EPS: $1.47, up from $1.23; and Adjusted Diluted EPS1: $1.49, up from $1.30.

1 Revenue, Excluding Billable Expenses, Adjusted Operating Income, Adjusted Net Income, Adjusted EBITDA, Adjusted Diluted EPS, and Free Cash Flow are non-GAAP financial measures. See “Non-GAAP Financial Information” below for additional detail.

Financial Outlook

For our full fiscal year 2018, we are revising our guidance upward:

- Revenue: Growth in the 5.5 to 7.5 Percent Range

- Diluted EPS: $1.86 - $1.94

- Adjusted Diluted EPS1: $1.87 - $1.95

These EPS estimates are based on fiscal 2018 estimated average diluted shares outstanding of approximately 148.0 million shares, and assume an effective tax rate in the range of 33 percent to 34 percent, which reflects changes in U.S. tax law. The estimated average diluted shares outstanding used for purposes of our revised guidance has been updated from approximately 149.5 million used in prior guidance, which excluded certain estimated legal expenses, to reflect the net effect of the repurchase of shares during fiscal year 2018.

Conference Call Information

Booz Allen will host a conference call at 8:00 a.m. EST on Monday, February 5, 2018, to discuss the financial results for its third quarter fiscal 2018 (ended December 31, 2017). Analysts and institutional investors may participate on the call by dialing (877) 375-9141 International: (253) 237-1151. The conference call will be webcast simultaneously to the public through a link on the investor relations section of the Booz Allen Hamilton web site at investors.boozallen.com. A replay of the conference call will be available online at investors.boozallen.com beginning at 11:00 a.m. EST on February 5, 2018, and continuing for 30 days.