May 29, 2018

Annual Revenue of $6.2 billion, Record Since IPO, and an Increase of 6.3 Percent

Annual Net Income of $305.1 million

Annual Adjusted EBITDA Margin on Revenue1 of 9.5%

Full Year Adjusted Diluted Earnings Per Share1 of $2.01, Record Since IPO

17.9 percent Increase in Total Backlog to $16 Billion, Year-end Record Since IPO, and Annual Headcount Increase of More than 1,300

Quarterly Dividend of $0.19 per Share, Payable on June 29, 2018

McLean, Virginia – Booz Allen Hamilton Holding Corporation (NYSE: BAH), the parent company of management and technology consulting and engineering services firm Booz Allen Hamilton Inc., today announced preliminary results for the fourth quarter and full year of fiscal 2018.

Strong fiscal 2018 results, including the highest annual revenue and Adjusted EBITDA1 since the Company’s IPO, along with significant headcount and backlog gains for the year, demonstrate the Company’s ability to deliver against its Vision 2020 growth strategy, and position it for further growth in fiscal 2019 and beyond. For the full fiscal year, the Company returned $373 million to shareholders in the form of regular dividends and share repurchases. It also acquired the cyber managed services firm Morphick, Inc. in fiscal 2018.

“The hard work and dedication of more than 24,000 colleagues resulted in record profitability and a third consecutive year of industry-leading organic revenue growth,” said Horacio Rozanski, President and Chief Executive Officer. “We are succeeding in the market and creating value for our investors because we deeply understand the missions of our clients and provide transformational solutions in areas of greatest demand.”

Headcount increased by more than 1,300 year-over-year, a 5.7 percent increase. Total backlog increased by 17.9 percent over the prior year to $16 billion, a year-end record since the IPO. The Company generated a full-year book-to-bill ratio of 1.39.

In fiscal year 2018, the Company realized tax benefits as follows:

- A benefit of $14.2 million as a result of a lower federal tax rate due to the Tax Cuts and Jobs Act (the “2017 Tax Act”). A majority of this benefit was realized in the third quarter of 2018.

- A $9.1 million income tax benefit that relates entirely to the re-measurement of deferred tax assets and liabilities using the new 21 percent federal tax rate. This one-time, non-cash benefit was recognized in the fourth quarter of 2018, the effect of which has been excluded from non-GAAP Adjusted Net Income1 and Adjusted Diluted Earnings Per Share1. Future adjustments are possible pending further guidance that may be issued by the IRS. It is anticipated that any future adjustments will be treated similarly and would also be reflected as a non-GAAP adjustment.

- A benefit of $14.5 million due to the adoption of the new stock-based compensation accounting standard, ASU 2016-09.

The Company declared a regular quarterly dividend of $0.19 per share, which is payable on June 29, 2018, to stockholders of record on June 14, 2018.

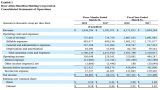

Financial Summary

Full Fiscal Year 2018, Ended March 31, 2018 – A summary of Booz Allen’s results for the full year of fiscal 2018 is below. All comparisons are to the prior fiscal year, and a description of key drivers for the full fiscal year can be found in the Company’s Earnings Call Presentation for the fiscal year 2018 posted on investors.boozallen.com.

- Revenue: $6.17 billion, an increase of 6.3 percent.

- Revenue, Excluding Billable Expenses:1 $4.31 billion, an increase of 6.3 percent.

- Operating Income and Adjusted Operating Income:1 Each $520.1 million, an increase of 7.4 percent and 5.7 percent, respectively.

- Net Income: $305.1 million, an increase of 20.8 percent; and Adjusted Net Income:1 $297.7 million, an increase of 13.5 percent.

- EBITDA and Adjusted EBITDA:1 Each $584.8 million, an increase of 7.6 percent and 6.9 percent, respectively.

- Diluted EPS: $2.05, up from $1.67; and Adjusted Diluted EPS:1 $2.01, up from $1.75.

As of March 31, 2018, total backlog was $16.0 billion, compared to $13.6 billion as of March 31, 2017, an increase of 17.9 percent. Net cash provided by operating activities for the fiscal year was $369.1 million as compared to $382.3 million in the prior year. Free cash flow1 for the fiscal year was $290.7 million, compared with $328.4 million in the prior year.

Fourth Quarter Ended March 31, 2018 – A summary of Booz Allen’s results for the fourth quarter of fiscal 2018 is below. All comparisons are to the prior year period.

- Revenue: $1.63 billion, an increase of 3.4 percent.

- Revenue, Excluding Billable Expenses:1 $1.15 billion, an increase of 4.7 percent.

- Operating Income and Adjusted Operating Income:1 Each $136.0 million, an increase of 5.3 percent and 4.5 percent, respectively.

- Net Income: $84.9 million, an increase of 28.1 percent; and Adjusted Net Income:1 $76.2 million, an increase of 13.3 percent.

- EBITDA and Adjusted EBITDA:1 Each $152.6 million, an increase of 5.2 percent for both.

- Diluted EPS: $0.58, up from $0.44; and Adjusted Diluted EPS:1 $0.52, up from $0.45.

The Company ended the quarter with a cash balance of approximately $287 million, and during the fiscal year the Company paid approximately $103 million in dividends and repurchased approximately 7.6 million shares.

1 Revenue, Excluding Billable Expenses, Adjusted Operating Income, Adjusted Net Income, Adjusted EBITDA, Adjusted Diluted EPS, Adjusted EBITDA Margin on Revenue and Free Cash Flow are non-GAAP financial measures. See “Non-GAAP Financial Information” below for additional detail.

Financial Outlook

For our fiscal 2019, we are providing the following guidance:

- Revenue: Growth in the 6 to 8 percent range

- Adjusted Diluted EPS: 1 $2.35 - $2.50

This EPS estimate is based on fiscal 2019 estimated average diluted shares outstanding in the range of 141 million to 145 million shares, and assumes an effective tax rate in the range of 25 percent to 27 percent, which reflects changes in U.S. tax law.

Conference Call Information

Booz Allen will host a conference call at 8 a.m. EDT on Tuesday, May 29, 2018, to discuss the financial results for its Fourth Quarter and Full Year Fiscal 2018 (ended March 31, 2018).

Analysts and institutional investors may participate on the call by dialing (877) 375-9141 International: (253) 237-1151. The conference call will be webcast simultaneously to the public through a link on the investor relations section of the Booz Allen Hamilton web site at investors.boozallen.com. A replay of the conference call will be available online at investors.boozallen.com beginning at 11 a.m. EDT on May 29, 2018, and continuing for 30 days.