May 22, 2017

Milestone Year of Accelerated Growth

Full-Year Revenue Increased by 7.4 percent to $5.80 billion

Full-Year Diluted Earnings per Share of $1.67 and Adjusted Diluted Earnings per Share1 of $1.75

Headcount Increase of nearly 720 year-over-year

Quarterly Dividend of $0.17 per share, Payable on June 30, 2017

McLean, Virginia – Booz Allen Hamilton Holding Corporation (NYSE:BAH), the parent company of management and technology consulting and engineering services firm Booz Allen Hamilton Inc., today announced preliminary results for the fourth quarter and full year of fiscal 2017.

For the full year, the Company reported an increase in revenue of 7.4 percent as compared to fiscal 2016 and solid bottom line earnings. Headcount increased by nearly 720 over the prior year, which includes the employees from the January acquisition of Aquilent. Solid awards in fiscal 2017 resulted in a total backlog increase of 15 percent over the prior year and generated an annual book-to-bill ratio of 1.31. The fourth quarter book-to-bill ratio was 1.04, the highest ratio for a fourth quarter since the firm became public in 2010.

“The great fiscal year 2017 results we report today demonstrate success that has been built by the people of Booz Allen over the past several years,” said Horacio Rozanski, President and Chief Executive Officer. “We are transforming our business to bring clients advanced, integrated solutions that address their most pressing needs. We are proud of our position as the government services industry’s organic revenue growth leader and our long record of success in delivering value to investors.”

The Company declared a regular quarterly dividend of $0.17 per share, which is payable on June 30, 2017, to stockholders of record on June 10, 2017.

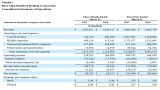

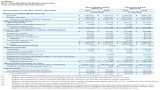

Financial Summary

Full Year Fiscal 2017 – A summary of Booz Allen’s results for the full year fiscal 2017 is below. All comparisons are to the prior year, and a description of key drivers can be found in the Company’s Earnings Call Presentation for the Fiscal Year 2017 posted on investors.boozallen.com.

- Revenue: $5.80 billion, an increase of 7.4 percent.

- Revenue, Excluding Billable Expenses:1 $4.05 billion, an increase of 4.1 percent.

- Operating Income: $484.2 million, an increase of 8.9 percent; and Adjusted Operating Income:1 $491.8 million, an increase of 9.6 percent.

- Net Income: $252.5 million, a decrease of 14.2 percent; and Adjusted Net Income:1 $262.4 million, an increase of 6.5 percent.

- Adjusted EBITDA1: $547.1 million, an increase of 8.1 percent.

- Diluted EPS: $1.67, decreased from $1.94; and Adjusted Diluted EPS1: $1.75, increased from $1.65.

As of March 31, 2017, total backlog was $13.6 billion, compared to $11.8 billion as of March 31, 2016, an increase of 15 percent. All components of backlog grew compared to the prior year. Net cash provided by operating activities for fiscal 2017 was $382.3 million, compared with $249.2 million in the prior year. Free cash flow1 for fiscal 2017 was $328.4 million, compared with $182.6 million in the prior year.

Fourth Quarter Ended March 31, 2017 – A summary of Booz Allen’s results for the fourth quarter of fiscal 2017 is below. All comparisons are to the prior year period, and a description of key drivers can be found in the Company’s Earnings Call Presentation for the Fiscal Year 2017 posted on investors.boozallen.com.

- Revenue: $1.58 billion, an increase of 11.1 percent.

- Revenue, Excluding Billable Expenses:1 $1.10 billion, an increase of 9.2 percent.

- Operating Income: $129.2 million, an increase of 23.6 percent; and Adjusted Operating Income:1 $130.2 million, an increase of 23.4 percent.

- Net Income: $66.3 million, an increase of 1.1 percent; and Adjusted Net Income1: $67.3 million, an increase of 9.8 percent.

- Adjusted EBITDA:1 $145.1 million, compared with $119.4 million.

- Diluted EPS and Adjusted Diluted EPS1: $0.44 and $0.45, respectively, compared to $0.43 and $0.41, respectively.

1 Revenue, Excluding Billable Expenses, Adjusted Operating Income, Adjusted Net Income, Adjusted EBITDA, Adjusted Diluted EPS, and Free Cash Flow are non-GAAP financial measures. See “Non-GAAP Financial Information” below for additional detail.

Financial Outlook

For our fiscal 2018, we are providing the following guidance:

- Revenue: Growth in the 4 to 7 Percent Range

- Diluted EPS: $1.76 - $1.86

- Adjusted Diluted EPS: $1.79 - $1.89

1) These EPS estimates are based on fiscal 2018 estimated average diluted shares outstanding of approximately 149.5 million shares, and assumes an effective tax rate in the range of 39 percent to 40 percent.

Conference Call Information

Booz Allen will host a conference call at 8:00 a.m. EDT on Monday, May 22, 2017, to discuss the financial results for its fourth quarter and full year fiscal 2017 (ended March 31, 2017). Analysts and institutional investors may participate on the call by dialing (877) 375-9141 International: (253) 237-1151. The conference call will be webcast simultaneously to the public through a link on the investor relations section of the Booz Allen Hamilton web site at investors.boozallen.com. A replay of the conference call will be available online at investors.boozallen.com beginning at 11:00 a.m. EDT on May 22, 2017, and continuing for 30 days.