January 30, 2017

Third Quarter Revenue Increased by 7.4 percent to $1.40 billion

Headcount Increase of approximately 440 year-over-year

Continued Strong Backlog of $13.5 billion

Diluted Earnings per Share of $0.37 and Adjusted Diluted Earnings per Share1 of $0.38

13 percent Increase in Quarterly Dividend to $0.17 per share, Payable on February 28, 2017

McLean, Virginia – Booz Allen Hamilton Holding Corporation (NYSE:BAH), the parent company of management and technology consulting and engineering services firm Booz Allen Hamilton Inc., today announced preliminary results for the third quarter of fiscal 2017.

The Company reported another strong quarter of year-over-year revenue growth and solid bottom line earnings, and remains on track to achieve full-year objectives. Solid awards in the third quarter of fiscal 2017 generated a book-to-bill ratio of .92x in the seasonally light quarter and a 12 percent increase in total backlog over the prior year. Additionally, headcount increased by approximately 440 employees over the prior year period and nearly 290 employees over the second quarter of fiscal 2017.

“Booz Allen Hamilton pivoted to growth a year ago and continues to grow on a healthy trajectory,” said Horacio Rozanski, President and Chief Executive Officer. “The people of Booz Allen are implementing our long-term strategy for sustainable, quality growth by consistently delivering exceptional client service and advanced solutions that integrate mission knowledge, consulting expertise, and technical prowess.”

The Company authorized and declared a two-cent increase to its regular quarterly dividend, to $0.17 per share, which is payable on February 28, 2017, to stockholders of record on February 10, 2017.

FINANCIAL REVIEW

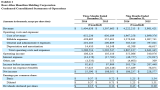

Third Quarter 2017 – A summary of results for the third quarter of fiscal 2017 and the key factors driving those results is below:

- Gross Revenue was $1.40 billion in the third quarter of fiscal 2017, an increase of 7.4 percent compared with the prior year period. The improvement was primarily driven by stronger client demand, which led to increases in client staff headcount and billability, and therefore direct labor. Revenue growth was also driven by an increase in billable expenses, including subcontractors and equipment purchased for clients on certain contracts.

- Operating Income increased to $108.1 million from $105.1 million, and Adjusted Operating Income1 increased to $109.2 million from $106.2 million in the prior year period, both primarily driven by the increase in Gross Revenue.

- Net Income decreased to $55.6 million from $108.1 million and Adjusted Net Income1 decreased to $56.6 million from $61.8 million in the prior year period. Each were driven by the factors associated with Operating Income and Adjusted Operating Income, respectively, and a modestly higher effective tax rate. Net Income in the third quarter excluded the benefit recognized in the prior year of the positive impact from the release of certain income tax reserves relating to the acquisition of the Company by The Carlyle Group in July 2008.

- Adjusted EBITDA1 increased to $122.5 million from $121.3 million in the prior year period. The increase was driven by the increase in Gross Revenue.

- Diluted EPS decreased to $0.37 from $0.71 in the prior year period, and Adjusted Diluted EPS decreased to $0.38 from $0.41. The decreases were primarily due to the decrease in Net Income and Adjusted Net Income, respectively. In addition, the diluted share count was higher than the same period last year.

As of December 31, 2016, total backlog was $13.5 billion, compared to $12.1 billion as of December 31, 2015, an increase of 12 percent. All components of backlog grew during the quarter compared to the prior year. Strong awards in the quarter generated a book-to-bill ratio of .92x, which represents our best third quarter book-to-bill in six years.

Nine Months Ended December 31, 2016 – Booz Allen’s cumulative performance for the first three quarters of fiscal 2017 has resulted in:

- Revenue of $4.22 billion for the nine months ended December 31, 2016, compared with $3.98 billion for the prior year period, an increase of 6.0 percent.

- Operating Income of $355.1 million for the nine months ended December 31, 2016, compared with $340.1 million for the prior year period, and Adjusted Operating Income of $361.6 million for the nine months ended December 31, 2016, compared with $343.2 million for the prior year period.

- Net Income for the nine months ended December 31, 2016 of $186.2 million, compared with $228.6 million for the prior year period, and Adjusted Net Income for the nine months ended December 31, 2016 of $195.1 million compared with $185.2 million in the prior year period.

- Adjusted EBITDA for the nine months ended December 31, 2016, of $402.0 million compared with $386.7 million for the prior year period.

- Diluted EPS and Adjusted Diluted EPS for the nine months ended December 31, 2016, of $1.23 and $1.30, respectively, compared to $1.51 and $1.24, respectively, for the prior year period.

- Net cash provided by operating activities for the first three quarters of fiscal 2017 was $283.0 million compared with $181.0 million in the prior year period. Free cash flow in the first three quarters of fiscal 2017 was $252.5 million, compared with $135.2 million in the prior year period. The increases were primarily due to revenue growth, which drove increased receivables that were collected in a timely manner, as evidenced by our generally consistent days sales outstanding, and greater management of spending. In addition, the Company benefited from lower cash tax payments due to timing of such payments as compared to the prior year period.

1 Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Diluted EPS, Adjusted Operating Income, Adjusted Net Income, and Free Cash Flow are non-GAAP financial measures. See “Non-GAAP Financial Information” below for additional detail.

FINANCIAL OUTLOOK

For our full year fiscal 2017 revenue guidance, we are raising the bottom and top end of the guidance we discussed on November 2, 2016. For the full year, we expect revenue to increase in the range of four to six percent. For our full fiscal year fiscal 2017, we are narrowing our Diluted EPS and Adjusted Diluted EPS guidance as previously issued on November 2, 2016. At the bottom line, we expect Diluted EPS to be $1.65 to $1.69 and Adjusted Diluted EPS to be $1.70 to $1.74.

These EPS estimates are based on fiscal 2017 estimated average diluted shares outstanding of approximately 150 million shares, and a 39.1 percent effective tax rate, which reflects the qualification of certain federal and state tax credits during the nine months ended December 31, 2016.

BAHPR-FI