FY19 Bottom Line and Margin Guidance Again Raised; Revenue Guidance Narrowed After Strong YTD Performance

Q3 Revenue Increase of 13.1 percent to $1.66 billion, and Revenue, Excluding Billable Expenses1 Growth of 12.2 percent

Diluted Earnings Per Share of $0.92 and Adjusted Diluted Earnings Per Share1 of $0.72

22.7 percent Increase in Total Backlog to $20.5 billion; and Book-to-Bill of 0.45x

Quarterly Dividend Raised By 4 Cents to $0.23 per Share

McLean, Virginia; February 1, 2019 - Booz Allen Hamilton Holding Corporation (NYSE: BAH), the parent company of management and technology consulting and engineering services firm Booz Allen Hamilton Inc., today announced preliminary results for the third quarter of fiscal 2019.

In the quarter, the Company continued very strong performance for the fiscal year, resulting in the raising of full-year guidance for Adjusted Diluted Earnings Per Share1 to between $2.65 and $2.75, the second consecutive quarterly increase in bottom line guidance for the fiscal year. The Company also raised guidance for Adjusted EBITDA Margin on Revenue1 to 10 to 10.5 percent, narrowed the Revenue guidance to 7 to 8 percent and reported continued headcount growth.

“Our third quarter results put us on track for another successful year, with significant increases in earnings driven by organic revenue growth and excellent contract-level performance,” said Horacio Rozanski, president and chief executive officer. “Booz Allen is operating at the intersection of consulting, technology and mission, which allows us to create value for clients and deliver on the revenue, profit margin, and capital deployment goals outlined in our Investment Thesis.”

The Company reported third quarter Revenue growth of 13.1 percent, and a 12.2 percent increase in Revenue, Excluding Billable Expenses.1 The strong top line growth and a lower corporate tax rate were among the contributors to a 76.2 percent increase in Net Income to $132.0 million and a 36.6 percent increase in Adjusted Net Income1 to $103.0 million. The Company also reported a 23.8 percent increase in Adjusted EBITDA1 to $179.7 million, and Adjusted EBITDA Margin on Revenue1 was 10.8 percent. Diluted EPS for the quarter was $0.92, up $0.41 or 80.4 percent, and Adjusted Diluted EPS1 for the quarter was $0.72, up $0.21 or 41.2 percent. Adjusted Net Income1 and Adjusted Diluted EPS1 each exclude the effect of a $29.0 million tax benefit the Company realized in its third quarter of fiscal 2019 from the approval by the Internal Revenue Service of a tax accounting method change.

Total backlog increased by 22.7 percent over the prior year period to $20.5 billion, and the Book-to-Bill ratio for the third quarter was 0.45x. As of December 31, 2018, headcount was more than 1,050 higher than the prior year, and increased by nearly 460 since the end of the prior quarter.

Reflecting strong performance, the Company declared a $0.04 cent increase in its quarterly dividend, to $0.23 per share, which is payable on February 28, 2019, to stockholders of record on February 14, 2019.

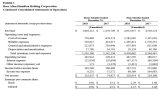

Financial Summary

All comparisons are to the prior year period, as restated as a result of the adoption of two accounting standards, ASC 606 and ASU 2017-07, that were both effective April 1, 2018. A description of key drivers can be found in the Company’s Earnings Call Presentation for the third quarter posted on investors.boozallen.com.

Third Quarter, ended December 31, 2018 - A summary of Booz Allen’s results for the third quarter of fiscal 2019 is below.

- Revenue: $1.66 billion, an increase of 13.1 percent.

- Revenue, Excluding Billable Expenses:1 $1.15 billion, an increase of 12.2 percent.

- Operating Income: $161.9 million, an increase of 26.0 percent; and Adjusted Operating Income:1 $161.9 million, an increase of 26.0 percent.

- Net Income: $132.0 million, an increase of 76.2 percent; and Adjusted Net Income:1 $103.0 million, an increase of 36.6 percent.

- EBITDA: $179.7 million, an increase of 23.8 percent; and Adjusted EBITDA:1 $179.7 million, an increase of 23.8 percent.

- Diluted EPS and Adjusted Diluted EPS:1 $0.92 and $0.72, respectively, up from $0.51 and $0.51, respectively.

As of December 31, 2018, total backlog was $20.5 billion, compared to $16.7 billion as of December 31, 2017, an increase of 22.7 percent. Net cash provided by operating activities for the third quarter of fiscal 2019 was $8.6 million as compared to $68.9 million in the prior year period. Free Cash Flow1 for the third quarter was $(9.8) million, compared with $42.8 million in the prior year period.

Nine Months Ended December 31, 2018 - Booz Allen’s cumulative performance for the first three quarters of fiscal 2019 has resulted in:

- Revenue: $4.92 billion, an increase of 8.5 percent.

- Revenue, Excluding Billable Expenses:1 $3.46 billion, an increase of 9.5 percent.

- Operating Income: $467.3 million, an increase of 20.4 percent; and Adjusted Operating Income:1 $471.0 million, an increase of 21.4 percent.

- Net Income: $329.0 million, an increase of 50.1 percent; and Adjusted Net Income:1 $305.1 million, an increase of 38.4 percent.

- EBITDA: $517.7 million, an increase of 18.7 percent; and Adjusted EBITDA:1 $521.3 million, an increase of 19.5 percent.

- Diluted EPS and Adjusted Diluted EPS:1 $2.27 and $2.12, respectively, up from $1.46 and $1.49, respectively.

1 Revenue, Excluding Billable Expenses, Adjusted Operating Income, Adjusted Net Income, Adjusted EBITDA, Adjusted Diluted EPS, Adjusted EBITDA Margin on Revenue and Free Cash Flow are non-GAAP financial measures. See “Non-GAAP Financial Information” below for additional detail.

Financial Outlook

For our fiscal 2019, we are updating guidance on Revenue, Adjusted EBITDA Margin on Revenue1 and Adjusted Diluted EPS1 issued on October 29, 2018:

- Revenue: Growth in the 7 to 8 percent range

- Adjusted EBITDA Margin on Revenue: 1 10 to 10.5 percent

- Adjusted Diluted EPS: 1 $2.65 - $2.75

This Adjusted Diluted EPS1 estimate is based on fiscal 2019 estimated average diluted shares outstanding in the range of 141 million to 144 million shares, and assumes an effective tax rate in the range of 24 percent to 26 percent, which excludes any re-measurements of our deferred taxes related to the Tax Cuts and Jobs Act, including benefits we realized during our third quarter of fiscal 2019 from the approval by the Internal Revenue Service of a tax accounting method change.

Conference Call Information

Booz Allen will host a conference call at 8 a.m. EST on Friday, February 1, 2019, to discuss the financial results for its Third Quarter of Fiscal 2019 (ended December 31, 2018).

Analysts and institutional investors may participate on the call by dialing (877) 375-9141 International: (253) 237-1151, using passcode 3886157. The conference call will be webcast simultaneously to the public through a link on the investor relations section of the Booz Allen Hamilton web site at investors.boozallen.com. A replay of the conference call will be available online at investors.boozallen.com beginning at 11 a.m. EST on February 1, 2019, and continuing for 30 days.